Corporations worldwide have been purchasing renewable energy at a record pace in recent years, pushing wind, hydroelectric, and solar energy past nuclear and coal for the first time last year. The U.S. Energy Information Administration also noted in its July “Today in Energy” report that renewables accounted for 834 billion kilowatt-hours of electricity in 2020 or 21 percent of the electricity generated in the United States.

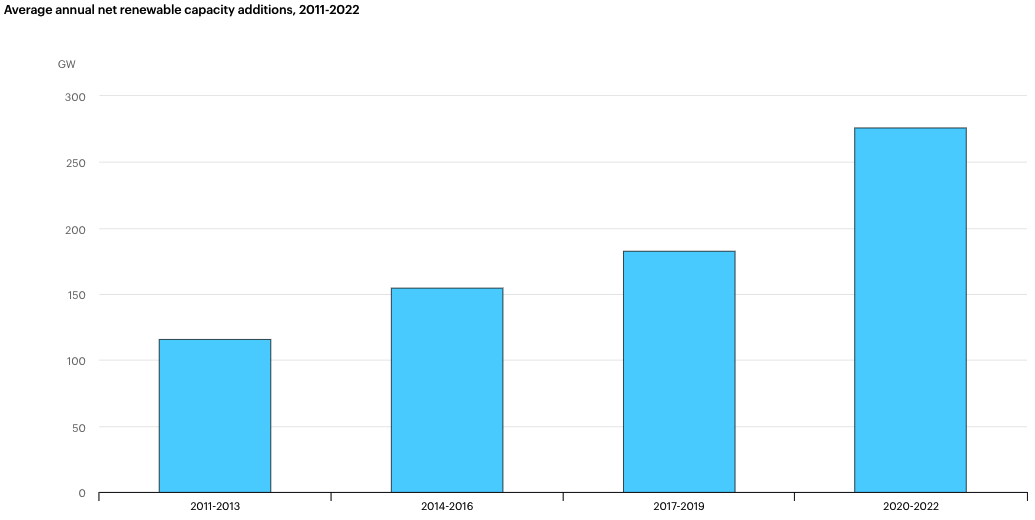

The trend is expected to continue as consumers, governments, and investors pressure companies to play a greater role in reducing greenhouse gases. And it seems the business world is listening. RE100 members – influential businesses committed to 100 percent renewable energy – have a combined demand for renewable electricity that is set to save CO2 emissions equivalent to the burning of more than 118 million tons of coal per year. Also, the world's renewable energy capacity additions jumped 45 percent in 2020, according to an International Energy Agency report, the largest annual rate of increase since 1999. Net renewable capacity went from 191.8 gigawatt-hours (GWh) in 2019 to 278.3 GWh in 2020.

Average Annual Net Renewable Capacity Additions, 2011-2022

Source: IEA, Average annual net renewable capacity additions, 2011-2022, IEA.

This emphasis on renewable energy is one reason your supply management department should be focusing on renewable energy procurement and working hand-in-hand with leadership to set corporate renewable energy goals. For organizations pursuing carbon abatement or net zero targets, a solid renewable energy procurement program is an essential part of an overall company energy strategy, according to a report by Deloitte.

Unlocking the Renewable Energy Procurement Conundrum identifies key steps in designing a renewable energy procurement framework. They include analyzing current and future energy demand, evaluating long-term renewable energy procurement options to mitigate exposure to wholesale market prices through retail contracts, and unlocking value from renewable solutions.

Sorting Out RECs and PPAs

Renewable energy procurement involves not only evaluating the energy needs and goals of your company, but navigating the complex world of renewable energy credits (RECs), bundled and unbundled RECs, power purchase agreements (PPAs), and virtual PPAs. Add to that considerations such as pricing, contract terms, risk management, and environmental obligations, and it’s easy to see that purchasing renewable energy can be a challenging supply management undertaking.

Understanding RECs and PPAs is a key first step in renewable energy procurement. It’s also important to be aware of the ever-changing trends in renewable energy as well as some of the relevant ways supply chain organizations can start a renewable energy procurement journey.

Renewable Energy Credits (RECs)

These are “tradeable instruments that represent the clean energy attributes of renewable energy and give the owner the legal right to claim renewable energy use from a specific source,” according to Urban Grid, a utility scale solar and energy storage developer. A comprehensive 2019 article by Urban Grid notes that one REC is created for every megawatt hour of renewable energy generated from sources such as solar, wind, hydropower, and geothermal energy.

There are two types of RECs that can be purchased, bundled and unbundled. Bundled RECs are sold with their associated energy while unbundled RECs are sold separately from the underlying energy. In its Guide for Corporate Renewable Energy Buyers, LevelTen Energy explains that bundled RECs often come from a new-build project because developers must show guaranteed revenue streams to finance and construct the project. Buying a bundled REC (electricity plus REC) “allows your company to make ‘additionality’ claims, meaning your company’s investment directly added new, low-cost renewable energy to the grid and displaced higher-cost fossil power.”

Unbundled RECs are not tied to their underlying power, they are nationally available, and they can be sourced from a single type of resource, such as solar or wind. Unbundled RECs provide versatility because they make renewable electricity available to all grid consumers regardless of the location of the generator or consumer on the grid, according to the EPA’s report Guide to Purchasing Green Power. The report calls unbundled REC procurement an entry point for organizations entering the green power market.

On the other hand, LevelTen’s report notes that unbundled RECs do not garner additionality claims. While helping an organization achieve sustainability goals, unbundled RECs do not lead to new renewable energy being generated, but “merely represent a reshuffling of the existing renewable energy supply.”

Power Purchase Agreements (PPAs) and Virtual PPAs

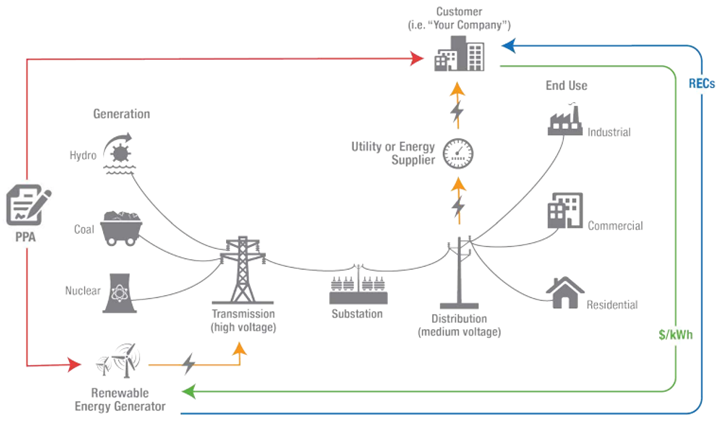

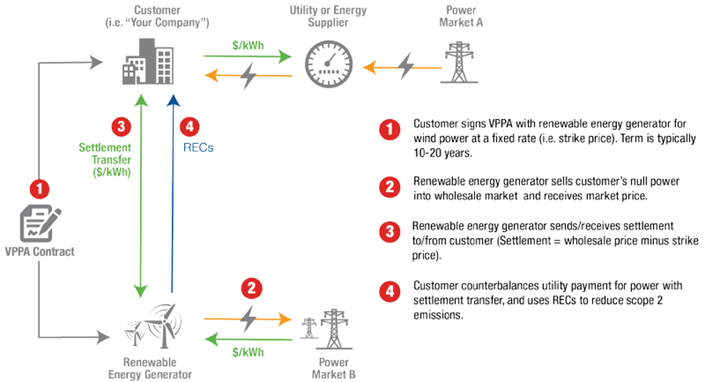

A PPA is a long-term electricity supply agreement between a power producer and an electricity customer. It’s a long-term contract to buy a project’s renewable energy and is a “critical factor in enabling the financing and construction of a new renewable energy project,” according to Urban Grid. With a virtual PPA, the buyer does not receive or take legal title to the energy.

Physical Power Purchase Agreements

Virtual Power Purchase Agreements

Source: Introduction to Virtual Power Purchase Agreements, Slides 15 and 20 - Physical PPA and Virtual PPA. EPA Green Power Partnership.

In its renewable energy report, Deloitte points out that a thorough assessment is required to analyze, compare, and select suitable PPA offers. According to the report, here are some important topics to consider:

- Pricing and terms are top concerns because renewable PPA prices are linked to the “scale of contracted volume, PPA term, location, and capacity factors for the project.” Agreements can range from seven to 15 years or even longer if it’s an on-site PPA.

- Because a PPA is long term, a complete risk assessment is necessary to identify key risks and design mitigation strategies.

- An off-site PPA carries the risk of network strength and can have impacts on the development, construction, and operation of the project.

It’s clear that the choices in a renewable energy procurement program will entail a thorough analysis of needs and goals. Urban Grid stresses that whether to buy inexpensive national RECs or bundled RECs with a long-term PPA depends on “budget, risk tolerance, your company’s emission reduction, and public relations goals.”

The EPA guide notes that a company’s goals will help guide its choice. If an organization’s goal, for example, is to manage fuel price risk it “might be more interested in entering into a physical or financial PPA.” A company focused on reliability of its power supply might look to on-site renewable generation coupled with storage.

Keeping Up with Trends

The renewable energy procurement landscape is constantly evolving with the marketplace. Following are some trends to watch from LevelTen and the REBA Institute.

New solutions to meet rising demand

The development of new, innovative ways to help companies overcome barriers to the PPA process are on the horizon, including new contract options and insurance products to mitigate risk as well as changes in project financing for developers and buyers.

Market-changing storage innovations

Solar-plus-storage projects took flight in 2019. Unlocking the value of grid-connected storage projects for corporate customers will open a new pathway to bring needed storage to the grid.

Expansion of competitive supply options

A push is underway for “tangible policy pathways that can be implemented today to increase access and decrease costs to renewable resources and accelerate the decarbonization of the power grid.” A REBA Institute report calls for expanding utilities’ renewable energy purchasing programs for commercial and industrial customers, and introducing supply choices for those customers. Allowing customers to “choose their suppliers provides opportunities to expand the access to renewables.”

While utilities have been responding to customer demand for renewable energy, there is a call in the energy industry for stronger partnerships between utilities and their customers, and for utilities to activate voluntary products as part of their strategic decarbonization strategy.

New companies entering the market

More diverse companies are entering the renewable energy market. REBA Institute’s State of the Market report found heavy industry joining big tech in the marketplace, although big tech strongly leads the field. The total capacity purchased by the heavy industry sector doubled from 511 megawatt hours in 2019 to 1,344 in 2020.

Setting Goals, Identifying Metrics

Finding the best fit for your company's renewable energy agenda and your supply chain organization’s procurement program requires identifying metrics and setting goals. The EPA’s green power guide offers some direction. In order to set goals, a company should consider:

- Why it wants to purchase green power

- The selection criteria important to the organization, such as visibility, resource type, costs

- Whether it has significant experience and expertise with energy procurement, or is a first-time buyer.

The guide points out that an “organization’s goals will be driven by its motivation for purchasing green power.” To spur organizations to define their motivations, the guide offers 11 examples of goals, ranging from reducing a company’s emission footprint to lowering electric costs to increasing shareholder satisfaction by reducing emission risk or liability. It adds: “Organizations that clearly document and communicate these goals inspire and sustain the structural change that is need to achieve these goals.”

It also emphasizes the need to have champions – senior C-level leaders – to “help align the interests of key decision-makers and garner support from important stakeholders.” First on the suggested list is a champion from “purchasing.” Some other suggestions include facilities/energy management and marketing.

Driving Change

There is little doubt the world of energy procurement is changing as businesses, consumers and government entities shift their attention from traditional energy sources to renewable energy. The demand for lowering greenhouse gas emissions may be strong, but so are the challenges for companies trying to meet renewable energy goals. That’s why it’s important for supply chain executives to develop a comprehensive renewable energy procurement program that can help drive and accelerate change throughout the company.

Non-members can receive the report of each survey they submit.

Members can access all reports, but are encouraged to submit surveys to

increase the comparative breakouts only they receive.