Our annual Metrics of Supply Management report provides KPIs for headcount, OPEX, spend, savings, ROI and more, broken out further across multiple industries.

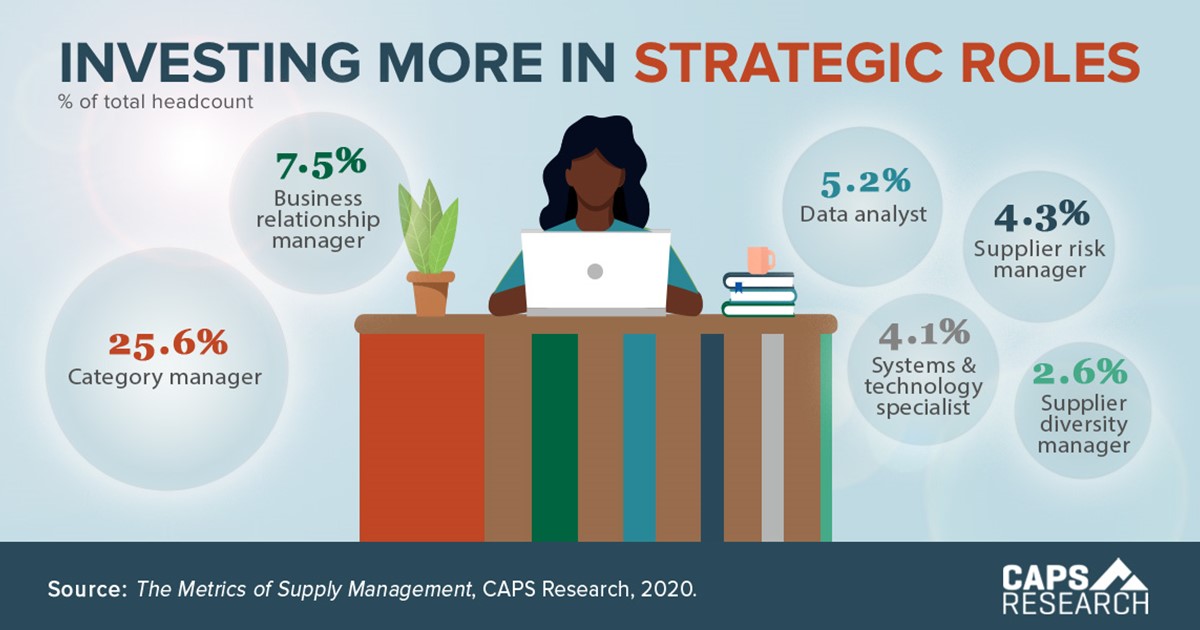

Investing More in Strategic Roles

As companies identify priorities and fill gaps, strategic hires of supply management professionals shift to reflect organizational needs. Compared to last year, supplier diversity positions increased by 1.4%, category managers by 3.9%, and data analysts by 1.1%.

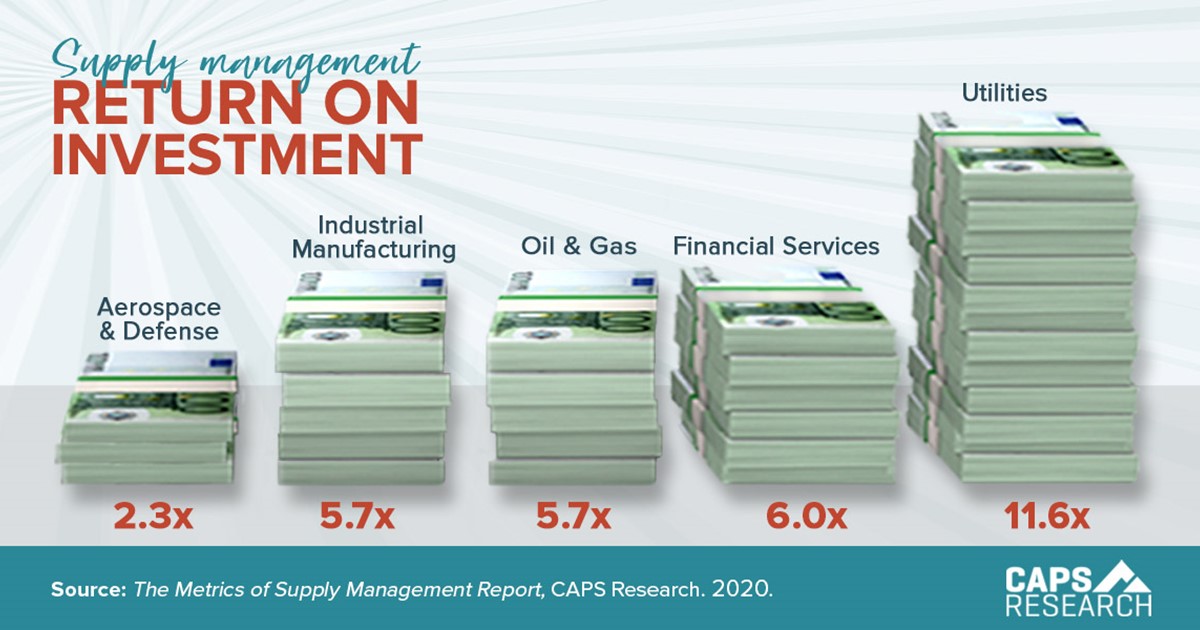

Supply Management ROI

Supply management (SM) return on investment (ROI) is a simple way to demonstrate the value of the function. To calculate your organization’s SM ROI – a powerful metric to communicate the value you deliver to stakeholders – divide cost savings (reduction + avoidance) by supply management operating expenses.

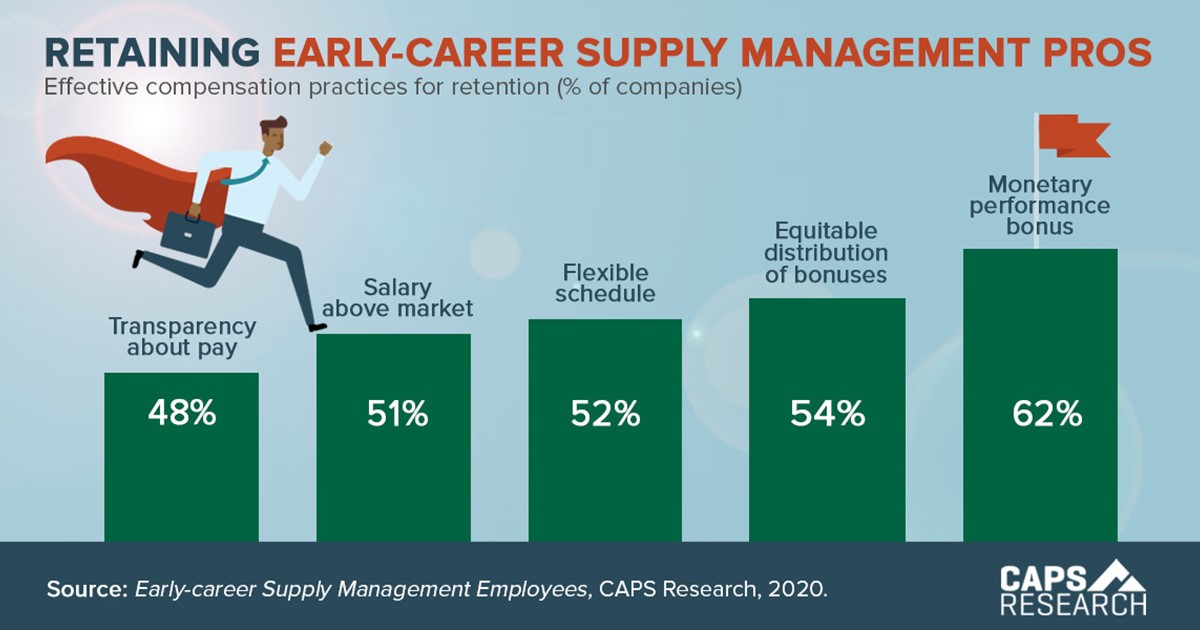

Retaining early-career supply management pros

What are the most effective compensation practices for retaining early-career supply management professionals? According to companies, performance bonuses top the list at 62%.

Job offers & early-career SM pros

What are the primary factors that increase acceptance of job offers by early-career supply management professionals?

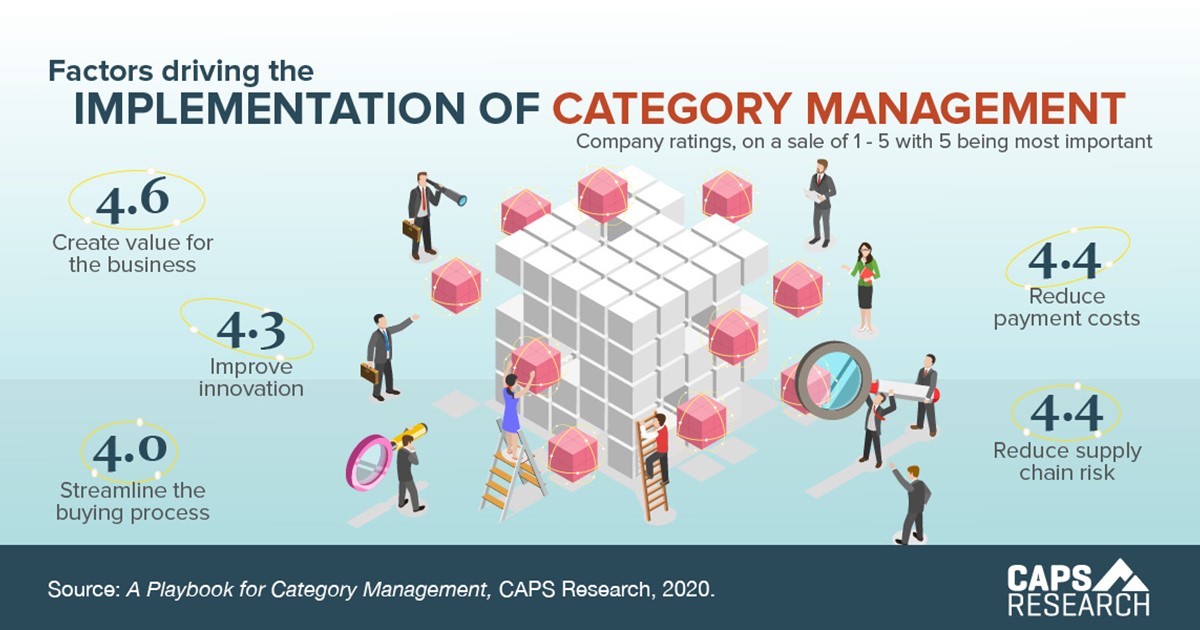

Factors driving the implementation of category management

The executives we surveyed said the top factors driving the implementation of category management include creating value for the business as the top factor, followed by reduced costs, and reduced supply chain risk.

Online Marketplaces

Online marketplaces are becoming more popular for B2B purchases. 73% of respondents are currently using or plan to start using online marketplaces.

Tactical v. strategic SM functions

Tactical sourcing activities are critical to keep organizations running smoothly, but supply management groups are now focusing more on strategy.

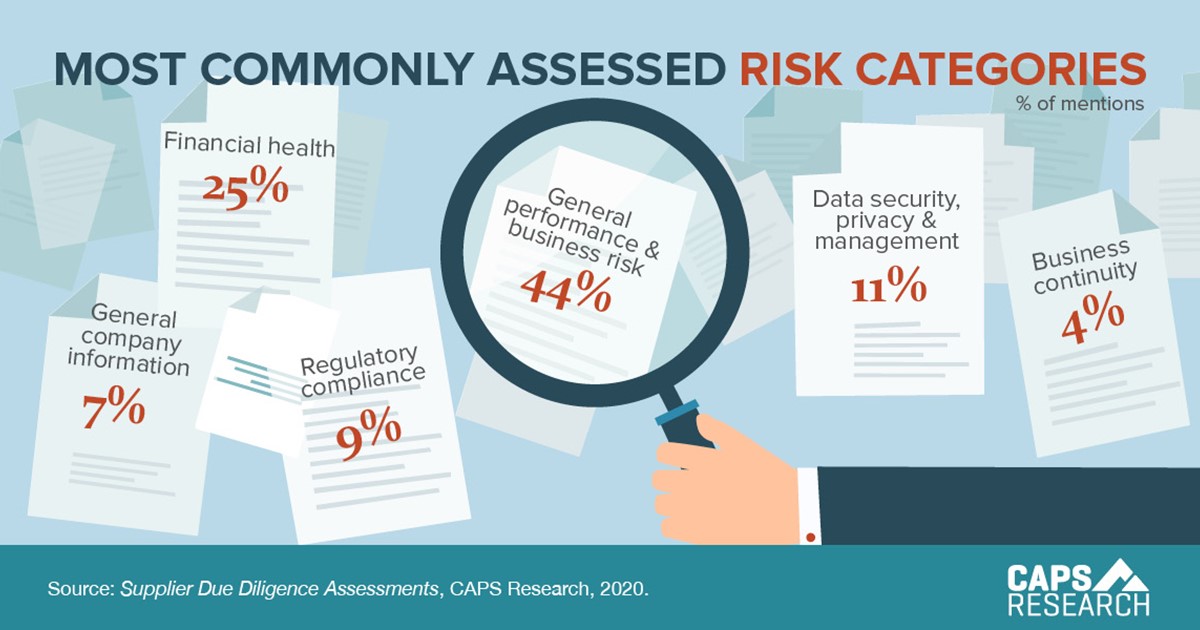

Most Commonly Assessed Risk Categories

We asked companies which risk categories they assess most often with “general performance and business risk” garnering the highest number of mentions at 44%.

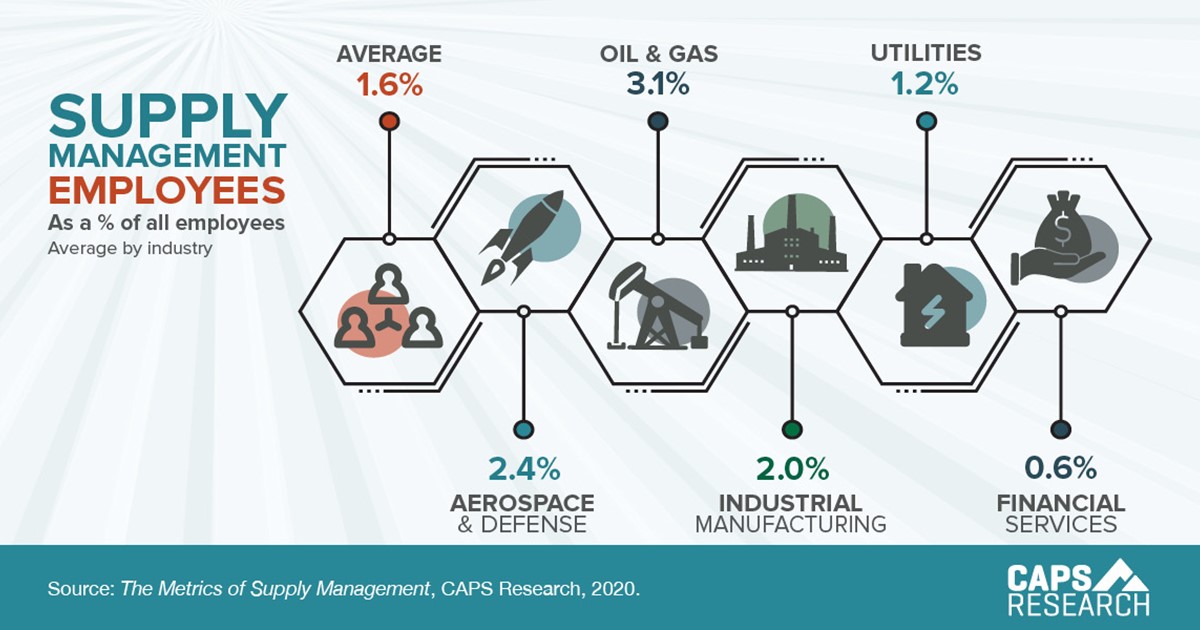

SM Employees as a % of All Employees

Across industries, supply management personnel relative to all company employees is 1.6% this year.

Non-members can receive the report of each survey they submit.

Members can access all reports, but are encouraged to submit surveys to

increase the comparative breakouts only they receive.