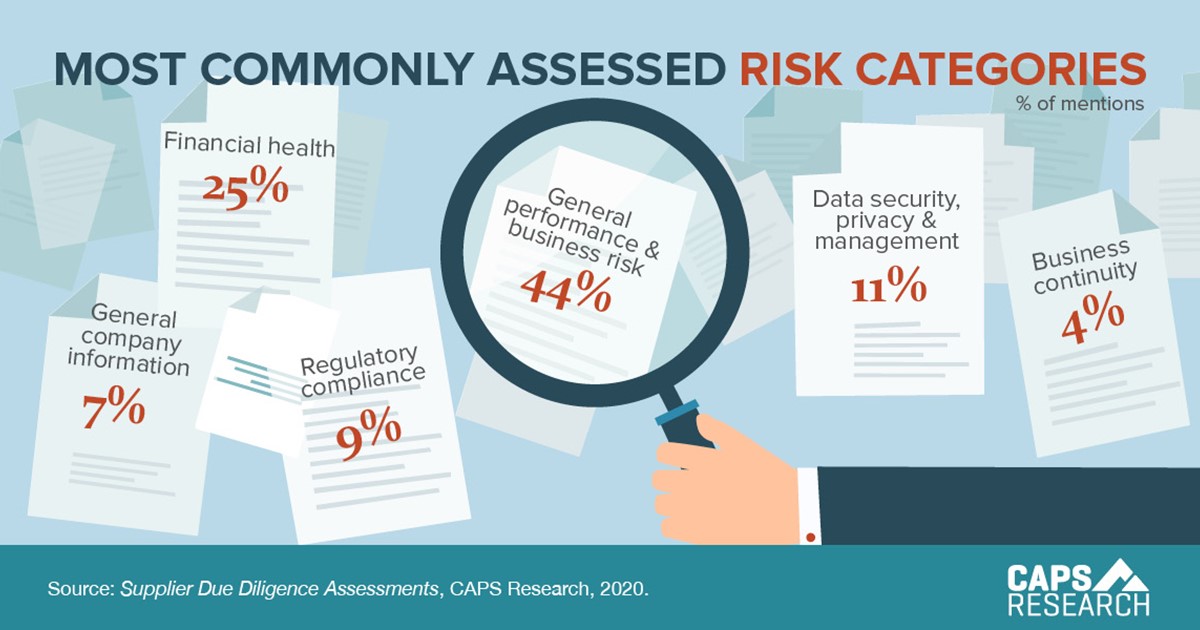

We asked companies which risk categories they assess most often with “general performance and business risk” garnering the highest number of mentions at 44%.

CAPS News - 7 Oct 2020

New metrics from our "Supplier Due Diligence Assessments" survey, the findings of a sustainability study on plastics pollution, and as always, opportunities to participate in surveys and get metric reports in return.

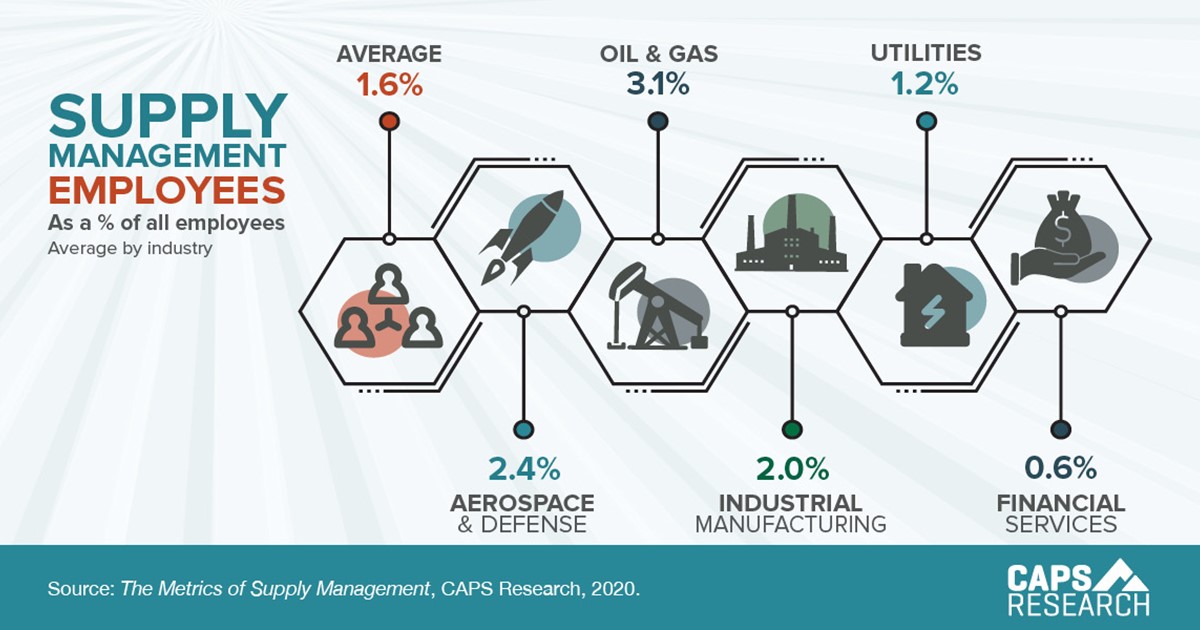

SM Employees as a % of All Employees

Across industries, supply management personnel relative to all company employees is 1.6% this year.

CAPS News - 23 Sept 2020

In this newsletter, we look at new data to increase transparency in the supply chain, travel & entertainment, survey opportunities, and more.

Metrics of the Future

Metrics of the Future investigates successful working relationships between procurement departments and their internal customers and how these relationships can be leveraged to improve business outcomes.

Cultivating internal relationships for supply management success

How teams can cultivate successful internal partnerships and what they provide to the organization beyond simply reducing costs

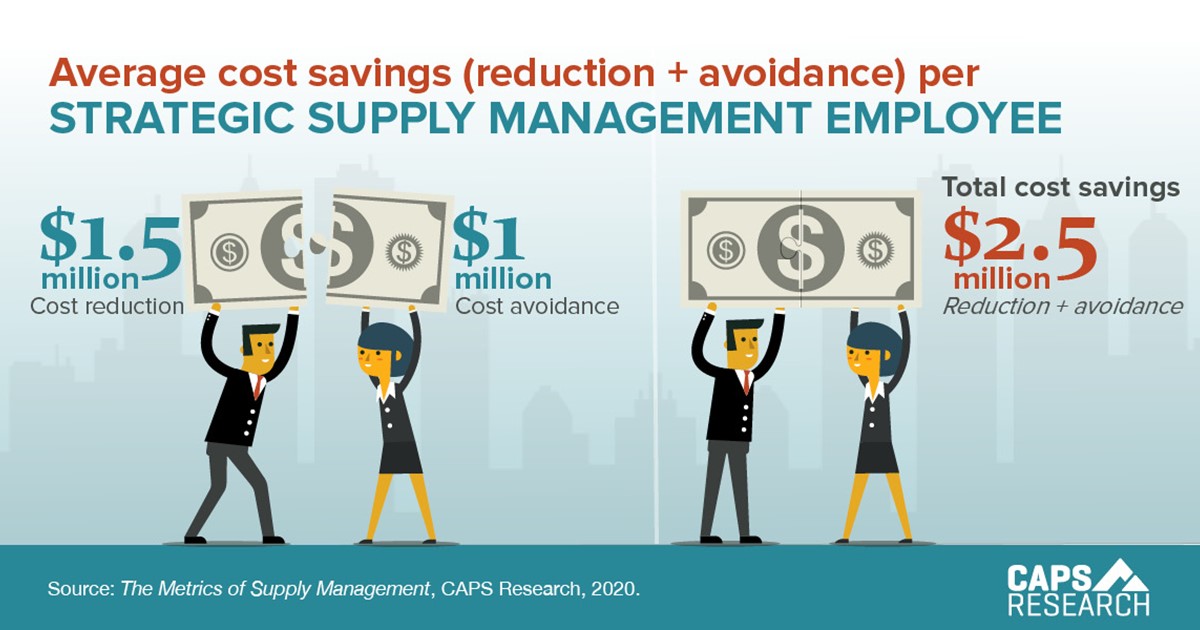

Average cost savings per employee

Cost savings is a powerful KPI for demonstrating the value of your supply management group. How much total cost savings are your strategic supply management employees delivering?

CAPS News - 9 Sept 2020

In this edition of CAPS News, we look at what compensation benefits retain early-career supply management employees, managing supplier quality, and more.

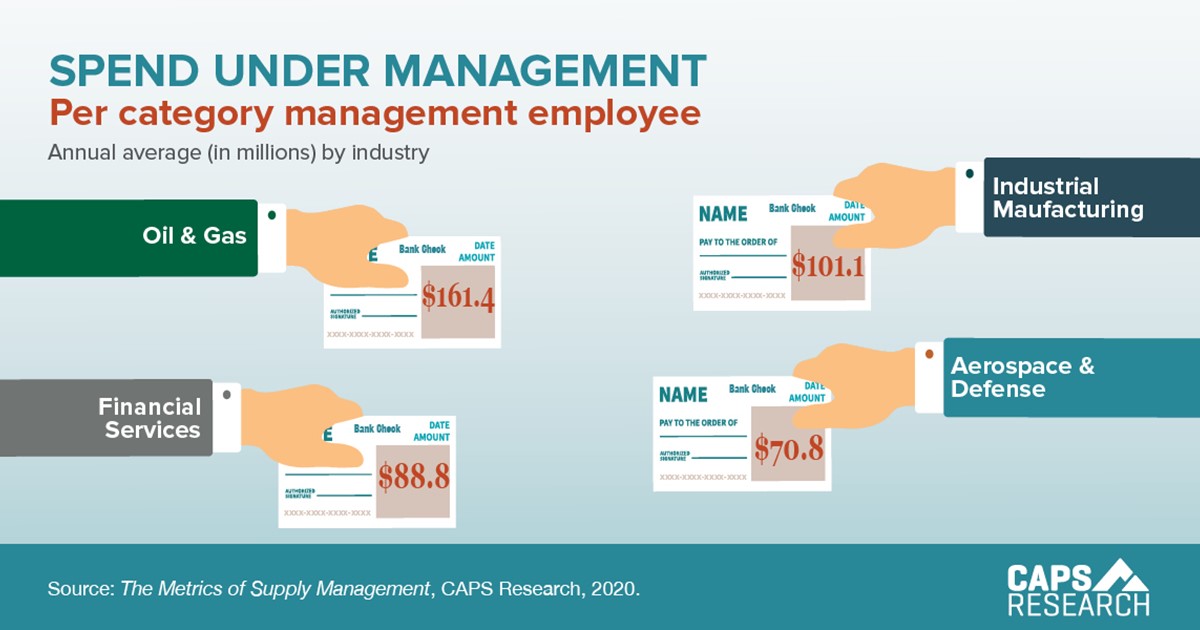

Spend under management

Across industries, category management employees comprise 15.6% of the total supply management headcount. We share their spend by industry.

CAPS News - 26 Aug 2020

At 83% of the companies we surveyed, supplier assessments are the responsibility of the supply management org - new metrics. Plus, mapping your supply network.